carried interest tax changes

Carried interest is taxed as capital gains. This 20 rate for carried interest is the top rate applicable to long-term capital gains which applies to carried interest if.

What Are The Consequences Of The New Us International Tax System Tax Policy Center

In August 2020 the IRS published proposed regulations in the Federal Register to implement the carried interest tax changes brought about by the TCJA.

. Modifying the limitation on deduction of business interest expense. The final regulations retain the basic structure of the proposed regulations with certain changes made in response to comments. Every president since George W.

Or sign in to your account. Taxpayers could see more guidance in 2021 regarding an elective worldwide interest expense allocation under section 864f. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees.

Result of these interactions is that carried interest is generally taxed as a capital gain or qualified dividend often at a rate of 20. Finance Chairman Wyden introduces carried interest bill August 5 2021 Download pdf 1566 KB US. Apart from the negative impact of tax.

New carried interest rules recharacterize long-term capital gains held less than three years to short term. Senate Finance Committee Chairman Ron Wyden D-OR and committee member Senator Sheldon Whitehouse D-RI re-introduced legislation to change the taxation of carried interestthe Ending the Carried Interest Loophole Act. The Final Regulations seemingly require that an unrelated non-service provider hold a similar capital interest in the same partnership as the person who owns the API in order for the capital interest exception to apply.

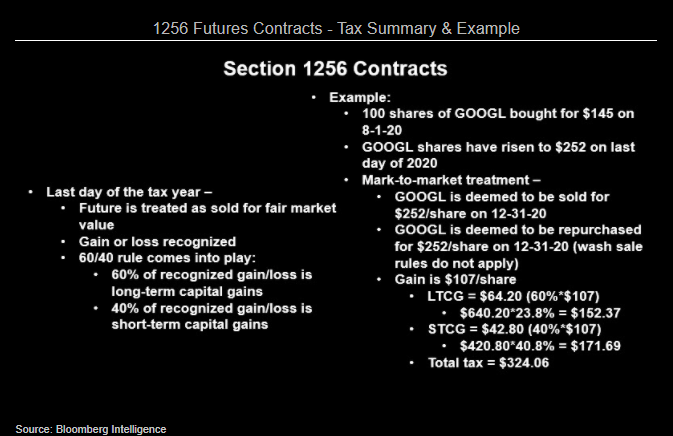

Under this interpretation sponsor capital invested through a co-invest. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20.

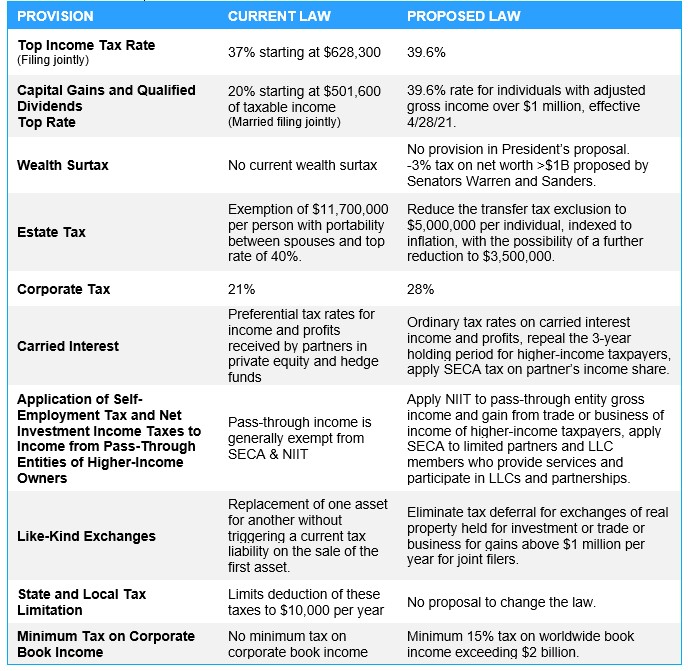

115-97 modified the taxation of carried interests by enacting Sec. Carried interest is a venture capital private equity or hedge fund investors cut of the profits from their investments and it is taxed as. Under Bidens proposals capital gains tax would increase to a potential 434 in 2021 including a 38 tax on net investment income from 238 for those with adjusted gross income exceeding 1 million.

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. Latham Watkins January 28 2021 Number 2853 Page 3. The preferential tax rate is especially important for a private equity fund and its managers.

The bill would amend Section 163j to apply the interest limitation at the partner level instead of at the partnership level as under current law effective for tax years beginning after. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. The White House will propose a major change to capital gains taxes with people earning more than 1 million per year paying the top marginal tax.

The carried interest changes would apply to tax years beginning after December 31 2021. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses. There is controversy over carried interest because the tax rules allow hedge funds private equity and real estate professionals to pay taxes on carried interest at the capital gains tax rate instead of the higher tax rate applicable to ordinary income.

We break down related issues including Section 1231 gains triple net leases selling an API and estate tax implications of related party transfers. The law known as the Tax Cuts and Jobs Act PL. The regulations addressed many outstanding issues and provided much needed clarity.

Carried interest is very generally a share of the profits in a partnership paid to its manager. These regulations became final five months later in January 2021. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary.

If Congress equalizes the rates on ordinary income and capital gains then the current advantageous treatment of carried interest becomes a non-issue for taxpayers with incomes above the required threshold. This will hit private equitys share in a funds profits. The matter has been adjourned for now.

Tax Rate Changes The TCJA lowered the tax rates for corporations and most pass-through businesses. Currently the portion of an investment funds returns that is paid to fund managers or general partners as compensation in the form of a. But closing the so-called carried interest loophole by taxing private equity profits at personal income rates instead of at lower capital gains rates is.

While the committee stopped short of taxing all carried interest as ordinary income the restrictions included in the bill pose a direct threat to philanthropic givers and the charitable sector as a whole. The carried interest tax break for private equity and venture capital firms is once again in the spotlight and founders could feel the results. Department of Treasury recently released proposed regulations related to carried interests.

The law known as the Tax Cuts and Jobs Act PL. This Code provision generally says that to qualify for tax-favoredlong-termcapital gains LTCGs treatment certain carried interest arrangements must meet a greater-than-three-yearholding period requirement. A Democratic Congress could mean big changes to the tax code but some practitioners are hoping lawmakers improve the carried interest legislation enacted recently instead of creating a new law out of whole cloth.

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

Definitive Guide To Carried Interest Book Private Equity International

Doing Business In The United States Federal Tax Issues Pwc

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Retirement Tax Incentives Supercharge The Fortunes Of Wealthy Americans Equitable Growth

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Will Congress Close The Carried Interest Loophole Bdo

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group

Lobbying Kept Carried Interest Out Of Biden S Tax Plan Bernstein Says

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)